Year: 2024

- Home

- 2024

Kalpvrishk0 Comments

The Importance of Wills and Trusts for Everyone

When it comes to financial planning and securing your legacy, wills and

Kalpvrishk0 Comments

Understanding Section 162A Executive Bonus Plans

When it comes to attracting and retaining top talent, offering competitive compensation

Kalpvrishk0 Comments

The Advantages of Using a Loan to Set Up Your Business: A Tax and Growth Perspective

Starting a business is an exciting journey, but it often requires substantial

Kalpvrishk0 Comments

Executive Bonus Plans: A Strategic Tool for Tax Savings

Executive bonus plans are a powerful financial tool for attracting and retaining

Kalpvrishk0 Comments

The Real Estate Mortgage Investment Conduits Act (“REMICs Act”)

Corresponding to §§ 860A-860G of Title 26 of the U.S. Code (the

Kalpvrishk0 Comments

Taxpayer Claims Refund

The Refund Statute Expiration Date (RSED) is the end of the time

Kalpvrishk0 Comments

The Usability of Real Estate Mortgage Investment Conduits (REMICs)

Introduction: Real Estate Mortgage Investment Conduits (REMICs) represent a specialized financial instrument

Kalpvrishk0 Comments

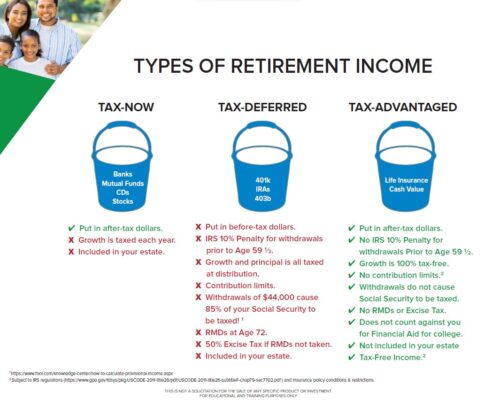

5 Self-Employed Retirement plans to consider for a secure financial future

Introduction As a self-employed individual, planning for retirement is crucial to ensure

All Categories

Recent Posts

Kalpvrishk0 Comments

The Importance of Wills and Trusts for Everyone

Kalpvrishk0 Comments

Understanding Section 162A Executive Bonus Plans

Kalpvrishk0 Comments