The Usability of Real Estate Mortgage Investment Conduits (REMICs)

Introduction:

Real Estate Mortgage Investment Conduits (REMICs) represent a specialized financial instrument within the realm of mortgage-backed securities. Created to promote liquidity in the real estate market and provide investors with unique opportunities, REMICs offer a range of features and benefits that make them a valuable component of investment portfolios.

I. Structure and Functionality:

- Pooling of Mortgages:

- REMICs facilitate the pooling of mortgages, allowing for the creation of mortgage-backed securities (MBS).

- Investors can gain exposure to a diversified portfolio of mortgages, reducing individual risk.

- Tranches:

- REMICs issue tranches, dividing the cash flows and risks into different classes.

- Investors can choose tranches based on their risk tolerance and income preferences.

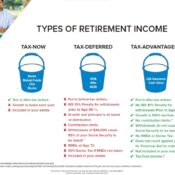

- Pass-Through Taxation:

- REMICs are structured as pass-through entities for tax purposes.

- Taxable income generated at the REMIC level is passed through to investors, potentially benefiting from lower tax rates.

II. Benefits for Investors:

- Stable Cash Flows:

- Regular interest payments provide investors with a stable income stream.

- Cash flows are generated from the underlying mortgage payments in the pool.

- Risk Management:

- Tranche structure allows investors to select their risk exposure.

- Senior tranches typically offer lower yields but with higher credit quality, appealing to conservative investors.

- Diversification:

- REMICs enable investors to diversify their portfolios by gaining exposure to various mortgage types and geographic regions.

- This diversification helps mitigate the impact of localized economic downturns.

III. Advantages in Real Estate Financing:

- Liquidity in Real Estate Markets:

- REMICs contribute to increased liquidity in the real estate market by providing an avenue for mortgage lenders to offload mortgage-backed securities.

- Access to Capital:

- Mortgage originators can use REMICs to raise capital by securitizing mortgage loans.

- This process facilitates increased lending capacity, promoting homeownership.

- Interest Rate Management:

- Mortgage lenders can use REMICs to manage interest rate risk by transferring it to investors.

- This allows lenders to focus on mortgage origination without being overly exposed to interest rate fluctuations.

<<<Book non obligatory appointment to save tax exploring REMICs>>>

IV. Considerations and Risks:

- Market Sensitivity:

- REMICs, like any investment, are subject to market conditions and interest rate fluctuations.

- Changes in economic conditions may impact the performance of underlying mortgages.

- Credit Risk:

- Investors should assess the credit quality of the underlying mortgages to understand potential risks.

- The tranche structure allows investors to select risk levels that align with their risk tolerance.

Conclusion:

Real Estate Mortgage Investment Conduits (REMICs) play a vital role in the real estate and financial markets by providing investors with opportunities for stable income, risk management, and portfolio diversification. While they offer numerous benefits, investors should carefully consider their risk appetite and conduct thorough due diligence. Consulting with financial professionals is advisable to ensure informed decision-making and effective integration of REMICs into investment strategies.

<<<Book non obligatory appointment to save tax exploring REMICs>>>